Benefits: Achieve cost reduction by reducing the prices you pay for parts and products

Strategy: Use data-driven discussion to base cost targets and negotiation on true manufacturing costs

Should Cost Analysis is a strategic cost management approach aimed at reducing the prices paid for parts and products by establishing cost reduction goals based on an accurate understanding of true manufacturing costs. Unlike arbitrary price cuts that may undermine supplier relationships and leave potential savings untapped, Should Cost Analysis provides a data-driven foundation for negotiations, ensuring that cost targets are realistic and achievable.

Typically, management sets cost reduction targets and expects suppliers to meet these reductions without a comprehensive analysis of the underlying manufacturing costs. This often leads to unrealistic price demands that can strain supplier relationships and potentially drive cost-competitive suppliers out of business. A more effective strategy involves comparing supplier price quotes against independent estimates of the true manufacturing costs, fostering informed discussions aimed at understanding and bridging any cost discrepancies.

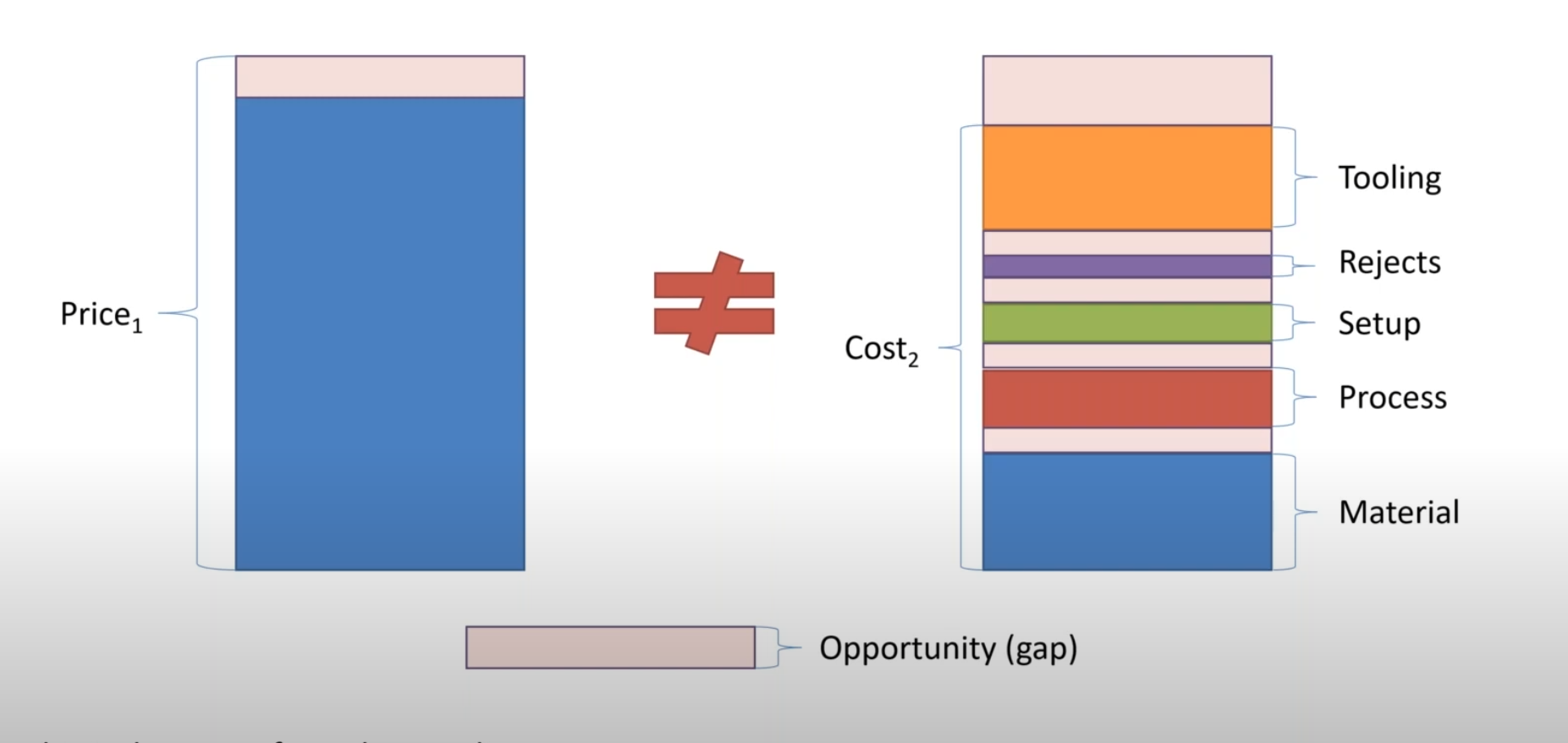

The Important Difference Between Price and Cost Information

A common pitfall in cost estimation is the reliance on historical price data. Historical pricing does not accurately reflect the current cost structure faced by suppliers when manufacturing new parts. This discrepancy can misguide negotiation efforts, directing focus toward areas with limited savings potential while overlooking significant cost-saving opportunities where suppliers may be overcharging.

To mitigate this, Should Cost Analysis eliminates the influence of historical prices, ensuring that negotiations are centered solely on the profit margin. By understanding the true cost to the supplier, organizations can identify genuine opportunities for cost reduction and foster fairer, more sustainable supplier relationships.

Key Components of Should Cost Analysis

Effective Should Cost Analysis encompasses several critical components that collectively ensure accurate cost estimation and successful cost reduction:

- Independent Cost Estimation: Develop an unbiased estimate of the manufacturing cost based on current data and industry standards.

- Cost Driver Identification: Pinpoint the primary factors that influence manufacturing costs, such as materials, labor, and overhead.

- Supplier Collaboration: Engage in transparent discussions with suppliers to understand their cost structures and identify areas for cost savings.

- Data-Driven Negotiations: Base negotiation strategies on accurate cost data rather than arbitrary price targets.

- Continuous Monitoring: Regularly review and update cost estimates to reflect changes in manufacturing processes and market conditions.

Should Cost Estimate Components

Should cost analysis breaks down the cost of a part into its material, process, setup, and tooling cost components, with each of these requiring thorough examination and accurate calculation.

Process and Setup Costs

The process and setup components of should cost estimates are based on hourly chargeout rates for a typical supplier. A chargeout rate is the hourly rate a supplier charges customers for a machine and operator. These supplier chargeout rates cover the cost of machine depreciation, energy and supplies used during processing, floorspace, selling, general and administrative overhead, and the fully burdened cost of machine operators and maintenance personnel. Supplier profit for running an operation is also included.

A should cost estimate based on these chargeout rates models the scenario where a company rents a machine and operator from the supplier for the time necessary to produce its parts. The cost of that rent, represented by the chargeout rate, covers all supplier costs as well as their profit margin.

Material Cost

The material cost component of should cost estimates is based on a fully burdened material cost per unit weight. This includes the base cost to purchase the material, the cost of material delivery to the supplier, administrative costs for tracking the material throughout the supplier facility, and profit to compensate the supplier for their effort in buying, handling, and selling the material.

A should cost estimate based on these fully burdened material costs models the supplier as an intermediary that purchases material from a material supplier and then sells that material to the company in the form of the parts being bought.

Tooling Cost

Similar to the process and setup cost components, the tooling cost estimates in should cost analysis are based on tool supplier chargeout rates. These rates account for all machine, supply, and toolmaker labor costs associated with tool production, including supplier profit.

A should cost tooling estimate based on tool supplier chargeout rates models the scenario where a company rents the equipment, purchases the supplies, and hires a toolmaker for the time required to produce dedicated tooling. The chargeout rate covers these costs as well as the tool supplier's profit.

Supplier Profit

The most common method to account for supplier profit is to add a constant percentage to the part's total manufacturing cost. However, this approach has drawbacks as it does not account for the varying levels of value-added labor across different parts. Consequently, suppliers may receive disproportionate profits regardless of the actual value they add, leading to overpayment for low-value contributions.

To address these issues, a more nuanced approach involves applying separate profit margins to each component of the part cost. For example, a higher profit margin can be applied to setup and processing costs, while a lower margin is assigned to material costs to reflect the supplier’s expenses related to purchasing, storing, and handling materials.

Additionally, when dealing with dedicated tooling, which typically involves low production volumes, a higher profit margin may be necessary to account for the increased costs associated with producing single or limited quantities of tools.

Implementing this method of accounting for supplier profit ensures a fairer distribution of costs, aligns supplier compensation with the value they add, and helps avoid overpaying for parts with minimal value-added processes.

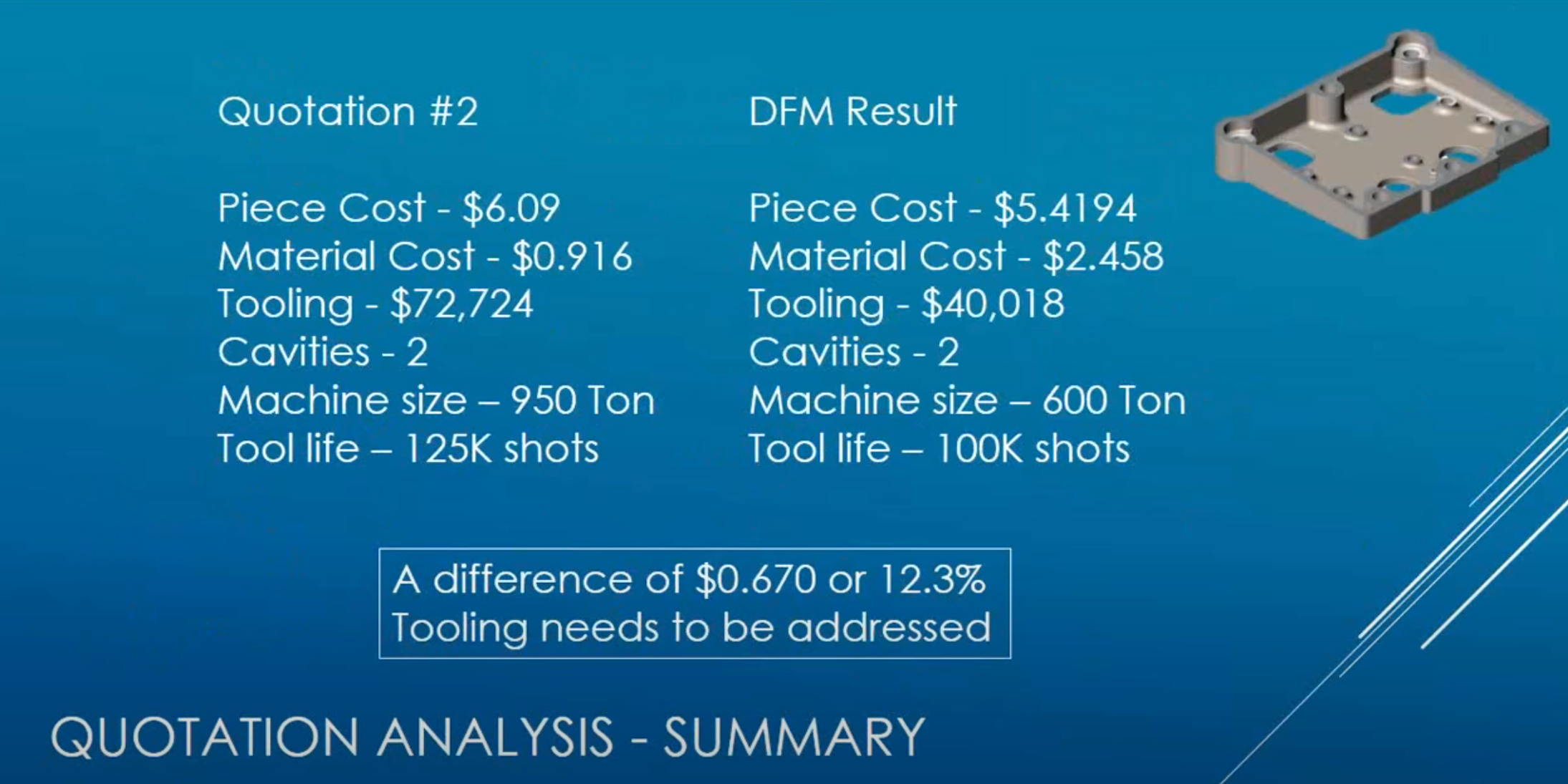

Negotiating with Suppliers Using DFM Concurrent Costing

DFM Concurrent Costing is an invaluable tool in the Should Cost Analysis process, enabling organizations to generate precise cost estimates in real-time. By focusing exclusively on the factors that genuinely drive manufacturing costs, DFM Concurrent Costing allows companies to assess whether a supplier’s quote is reasonable and justified.

The software translates complex cost data into a format that suppliers readily understand, eliminating disputes over estimate methodologies. This transparency fosters a fair and open Supplier Costing process, laying the groundwork for a sustainable and resilient supply chain.

Implementing Should Cost Analysis in Your Organization

To successfully implement Should Cost Analysis, organizations should follow these best practices:

1. Establish a Cross-Functional Team

Create a team that includes members from procurement, engineering, finance, and manufacturing. This diverse team ensures a comprehensive understanding of all cost factors and facilitates effective collaboration with suppliers.

2. Invest in Advanced Costing Tools

Utilize sophisticated costing software, such as DFM Concurrent Costing, to generate accurate and real-time cost estimates. These tools provide the necessary data to support informed negotiations and strategic decision-making.

3. Develop Detailed Cost Models

Create detailed models that break down the cost components of each part or product. These models serve as a foundation for comparing supplier quotes and identifying cost-saving opportunities.

4. Train Your Team

Provide training on Should Cost Analysis methodologies and tools. Ensuring that your team is well-versed in these techniques enhances the effectiveness of your cost reduction efforts.

5. Foster Transparent Supplier Relationships

Build strong, transparent relationships with suppliers based on mutual trust and understanding. Open communication channels facilitate the sharing of cost-related information and collaborative problem-solving.

6. Monitor and Adjust

Continuously monitor cost performance and adjust strategies as needed. Staying adaptable ensures that your Should Cost Analysis remains effective in the face of changing market conditions and evolving manufacturing processes.

Benefits of Implementing Should Cost Analysis

- Cost Reduction: Achieve significant savings by negotiating prices based on true manufacturing costs rather than arbitrary targets.

- Improved Supplier Relationships: Foster collaborative partnerships with suppliers built on transparency and mutual understanding.

- Enhanced Negotiation Power: Arm your team with accurate cost data to drive more effective and informed negotiations.

- Increased Profit Margins: Reduce the cost of parts and products, thereby enhancing overall profitability.

- Supply Chain Resilience: Develop a sustainable supply chain by ensuring that suppliers remain competitive and financially stable.

Conclusion

Should Cost Analysis is a transformative cost management strategy that empowers organizations to achieve meaningful cost reductions by basing price negotiations on an accurate understanding of true manufacturing costs. By leveraging tools like DFM Concurrent Costing and fostering transparent, data-driven discussions with suppliers, companies can not only reduce expenses but also build stronger, more resilient supply chains.

Implementing Should Cost Analysis requires a strategic commitment to data accuracy, cross-functional collaboration, and continuous improvement. However, the benefits—ranging from significant cost savings and improved profit margins to enhanced supplier relationships and supply chain stability—make it an essential practice for any organization striving for long-term success and competitiveness in today’s dynamic market environment.

Ready to optimize your manufacturing process with Should-Cost Analysis? Contact Us Today to get started!

Trump's Tariffs and Should-Cost Analysis: Understanding the Impact using DFMA

Trump's Tariffs and Should-Cost Analysis: Understanding the Impact using DFMA