|

mechanical engineering | January 2012 Jay Mortensen specializes in procurement strategy and engineering, target costing, and continuous improvement engineering. He has held positions as a cost optimization consultant at KPMG, chief financial officer at Rexnord FlattopGroup, Kaizen Engineer at Toyota and director of target costing at a major U.S. appliance manufacturer. He is currently a global procurement leader for a Korean manufacturer. He can be reached at jaypmortensen@gmail.com Domestic or Offshore: Teardowns help reveal the right manufacturing decision. By Jay Mortensen Most poor decisions occur when people are starved for useful information. This truth certainly applies to the trend, involving manufacturers from nearly every developed nation, of chasing the lowest out-of-country labor rates to achieve target costs. Offshoring production, followed by the return of goods and assemblies to their primary markets, is a decision seldom supported by hard numbers. Understanding how lack of knowledge about product design and accounting undermines domestic-based production—wherever it takes place—is the beginning of a journey by companies and countries toward achieving globally competitive manufacturing sourced in home markets. After a decade of experience, U.S. analysts have a much better understanding of the hidden costs of offshoring. These range from convoluted supply chains and expensive logistics to longer development times. These costs conservatively add 24 percent to the purchase price, according to a 2004 report, Improved Product Design Practices Would Make U.S. Manufacturing More Cost Effective: A Case to Consider Before Outsourcing to China, by Nicholas P. Dewhurst and David G. Meeker (www.dfma. com/truecost/index.html). The report was based on manufacturer interviews, sample product teardowns, and data from major consulting firms. Current research shows that total cost of ownership, which includes cost of operation, maintenance, disposal, and other overhead functions, adds an additional penalty to offshore products. What analysts know less about are the approaches to efficient product design and manufacture that can serve to minimize, and even reverse, any advantages that low-cost, out-of-country labor might provide. Several years ago, while employed with a large manufacturer of consumer products, I had an opportunity to see exactly how product redesign and manufacture could close the cost gap with an electrical motor. It showed how the unstated assumptions of established designs can produce unfair comparisons, and that rigorous and transparent costing models can make those assumptions visible and enable domestic suppliers to compete against offshore manufacturers. A case study: small electric motor assembly The motor in question was a fractional horsepower motor used in a home appliance. Like many companies, our company was constantly looking for ways to reduce costs. This motor was clearly more expensive than its offshore equivalent. It fell under my responsibility to make the case for either continuing to build it in the United States or to send production offshore. Almost every sourcing specialist I have spoken with over the last twenty years has advised me to look to China when I want small electric motors. I’ve seen all the arguments, and they convinced me that it was a product that could not be manufactured competitively in the U.S. Yet our previous experience with outsourced Chinese motors had included both quality and delivery issues. I had these challenges laid at my feet:

At first glance the solution seemed clear. Take the cheaper offshore quote, book the savings against your cost reduction goals for the year, and move onto the next project—case closed. Yet the logistical problems and quality control issues we’d experienced when offshoring were enough to convince management to take a closer look before we made a decision based on a simple spreadsheet. Instead, we decided to put the motor though a rigorous design analysis to identify quality, durability, performance, and cost variances between our existing motor and its offshore competitor. Some differences were immediately apparent. The most obvious was that our motor assembly was bigger and heavier than the one we were being encouraged to buy from an offshore producer. The “heft test” told us we were not comparing apples-to-apples. While it suggested some potential reasons for differences in cost, quality, performance, and durability, it did not provide the detailed information we needed to make an assessment. For that, we needed to tear both motors apart and look at how they were built. Comparative teardowns have been performed for generations. The issue I see that prevents teardowns from reaching their full potential is that they are not performed with rigorous standardization. To compare teardowns efficiently, companies need a consistent methodology to capture, measure, and then communicate information effectively. Too often people tend to tear something apart, look at the pieces, and extract just a limited amount of the data. When I’ve witnessed high-powered teardowns that consistently deliver results, they have been carefully controlled and the data collected so that it can be easily accessed and analyzed, from the shop floor to the boardroom. The results of our analysis found that the U.S. motor had a non-standardized design compared to industry norms. Quite simply, it was over-engineered for the application. The U.S. motor was bigger and weighed more than the offshore competitor. This meant it had greater material and material processing costs. Its design and manufacturing process also produced higher scrap than was acceptable. Continuous improvement in lean manufacturing (kaizen) and supply chain enhancements would generate roughly 1 to 2 percent reductions in the cost of the U.S. motor. This was well short of the 18.4 percent cost gap that separated it from the offshore motor. Analysis identified waste that could be designed out of our motor. By redesigning the motor to conform to industry norms, that is, by making it smaller and lighter, we had a better chance of closing the cost gap. Because the U.S. motor was over-engineered, no exotic technologies or special manufacturing processes were needed to reduce its cost. Instead, we could work with our existing suppliers to reduce motor size, weight, and scrap without sacrificing required performance. The teardown confirmed our first impressions from the heft test: Although the two motors had similar technical specifications, they were not really alike. While we could reengineer the U.S. motor to reduce size and weight, we first needed to know how our customers—the brand managers who made the appliance this motor would power—would react. This sent us to both our marketing and quality departments, to see if a redesigned U.S. sourced motor would meet our customers’ expectations. They revealed that our current motor assembly actually exceeded the market standard, and that customers did not see the value in a larger motor. So what was really happening here was that we were comparing a smaller product to a larger product. Once we verified that the change would fit our customers’ expectations—all of them—we could focus on whether we could retain the U.S. motor’s advantages in quality, durability, and logistics while reducing the cost gap between it and the offshore motor in terms of design, material, and manufacturing processes. What if? Our approach to value engineering the motor to reduce cost was to look at structural efficiency. This is the number of existing parts used to accomplish a product function compared against the theoretical minimum number of parts for the same function. To generate this data, we used Boothroyd Dewhurst DFMA product costing and structure simplification software. Working closely with our marketing department, we used DFMA to build a model to perform what-if design and manufacturing analysis. This enabled us to build a theoretical case for keeping production in the United States. The next step was to discuss the theory with our production and supply chain team members to get their views. A physical walk-through of the manufacturing facilities identified some lean manufacturing improvements. More important, though, it allowed us to see whether our supply chain indeed had the machine capability and line efficiency to manufacture the redesigned motor for the costs we predicted. With the support of the manufacturing and supply chain people and a better understanding of their production capabilities, we began to make detailed modifications to the motor design. By now, our team included not only engineers, but members of the marketing, quality, and purchasing departments, as well as suppliers. Together, our cross-functional team was able to grapple with a clear concern of management, that offshoring would be much faster than making changes in our domestic production. We found that the development time for a motor redesign would be similar to the work required to fit the generic offshore model to our needs. The final issue we needed to deal with was risk. Clearly, it was more risky to develop a new motor than to modify an off-the-shelf product from an offshore supplier to fit our appliance design. Yet the potential gain in quality, durability, and on-time delivery made this risk acceptable, especially since the entire cross-functional team was behind it. This consensus was possible only because the model and the data it generated showed how we could improve the structural efficiency of the proposed motor based on U.S. supply chain capabilities. Equally important, our model enabled us to review motor data with all relevant departments. Their challenges led to additional changes in the motor. Because we had a quantitative cost model, we could quickly analyze the proposed changes and their impact on price and performance without losing time on subjective debates. This made it far easier for different departments within the company to buy into the new design. The knowledge gained from having a standardized cost and review process allowed us to predict with confidence that we could close the cost gap between the U.S. and offshore motors. We predicted redesigning the U.S. motor would reduce costs by nearly 19 percent, with an additional 3 percent cost reduction from lean manufacturing and supply chain improvements. This would make the U.S. motor less expensive than its offshore competitor. In reality, further improvements in manufacturing lowered costs even more, while achieving the performance, quality, and shipment reliability we wanted. Take the lead In addition to specifying a more cost-effective motor, our company learned a lot from this exercise. To start with, we learned to ask the right questions. What started as a spreadsheet exercise in picking the least expensive motor to meet specifications instead became a lesson in understanding the design and manufacturing choices that lead to those differences. I believe that asking similar questions about motor assemblies (and perhaps a great deal else) is possible in any size company, at any volume of production, in any industry, in any country. From my own experience in the corporate world as a consultant and an employee, I believe this level of quantitative analysis is taking place in a growing number of U.S. companies. Yet it is mostly decoupled from cost discussions about offshoring, and how to use existing supply chains fully and creatively to preserve domestic manufacturing. This is a huge breakdown in the critical dialog among engineering, management, and accounting that erodes the viability of local suppliers in favor of an extended supply chain that is vulnerable to disruptions and not well-suited to rapid changes in direction. My own experience confirms what many analysts have remarked: Companies that profitably manufacture in the U.S. do not operate in silos. Experience in this application shows the importance of fostering candid interdepartmental communications as a normal part of operations. Candid discussions are necessary, but not always sufficient. I have seen in this application the importance of integrating objective data and predictive cost modeling from the “paper napkin” stage onward. This creates the basis for organization-wide brainstorming. With rigorous design analysis and standardized review processes in place, it is possible for teams (suppliers included) to foresee the cost viability of individual design elements and their alternatives. They can then make changes early to strengthen the competitiveness of the product. Let me emphasize these points: Profit is made when the product is designed. Design drives total cost—from manufacturing through to end of life—and should be the one thing relied upon most for making the right decisions. To concentrate just on offshoring, or slashing at the manufacturing side of the cost equation, is rarely sustainable. When I ask people why something was sent offshore, I’m often told, in effect, “Everyone is doing it so we thought it best to do the same.” The promised cost savings made it a trend that was difficult to resist. But being a leader is better. With reliable cost and design analysis, we can become the trendsetters and take control our own destiny.

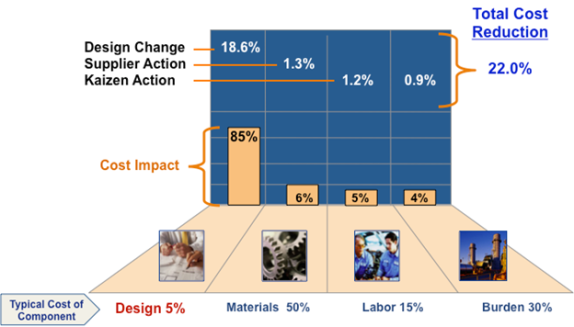

Motor Assembly Redesign Project Summary. Typical industrial budgets (lower line) allocate only about five percent to the design function. But that five percent actually influenced 85 percent of the final cost savings, which were 22 percent lower than the offshore bid for the motor. The lesson: invest more in upfront analysis and re-design. Late-stage Kaizen improvements reduced costs only 1.2 percent. |